Introduction: Why July 2025 & January 2026 SQE1 Exams Matter

The July 2025 and January 2026 SQE1 examinations are drawing significant attention from aspiring solicitors across the UK and internationally. As the SQE continues to establish itself as the definitive route to UK solicitor qualification, each examination sitting reveals evolving trends that can substantially impact preparation strategies. These two particular sittings are especially noteworthy, occurring at a crucial juncture where syllabus refinements meet accumulated data from previous examinations.

This comprehensive analysis combines official SRA syllabus updates, historical examination patterns, and candidate feedback to provide strategic insights for both examination periods. Our predictions will help legal education candidates plan their preparation with greater precision and confidence.

Key Terms

#SQE1 exam predictions July 2025, #January 2026 SQE, #FLK1 priorities, #FLK2 trends, #UK solicitor qualification

SQE1 Examination Framework Overview (FLK1 & FLK2)

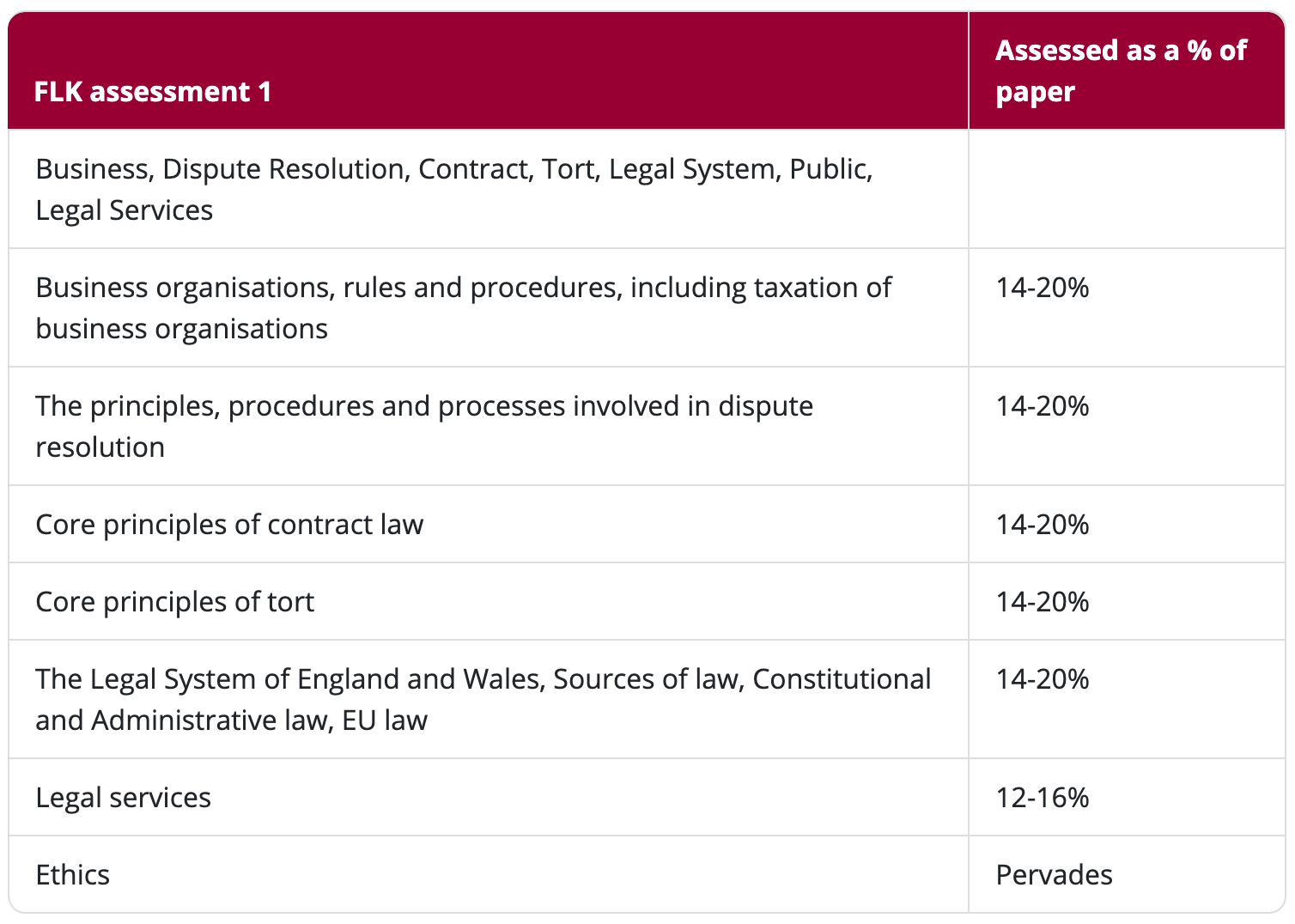

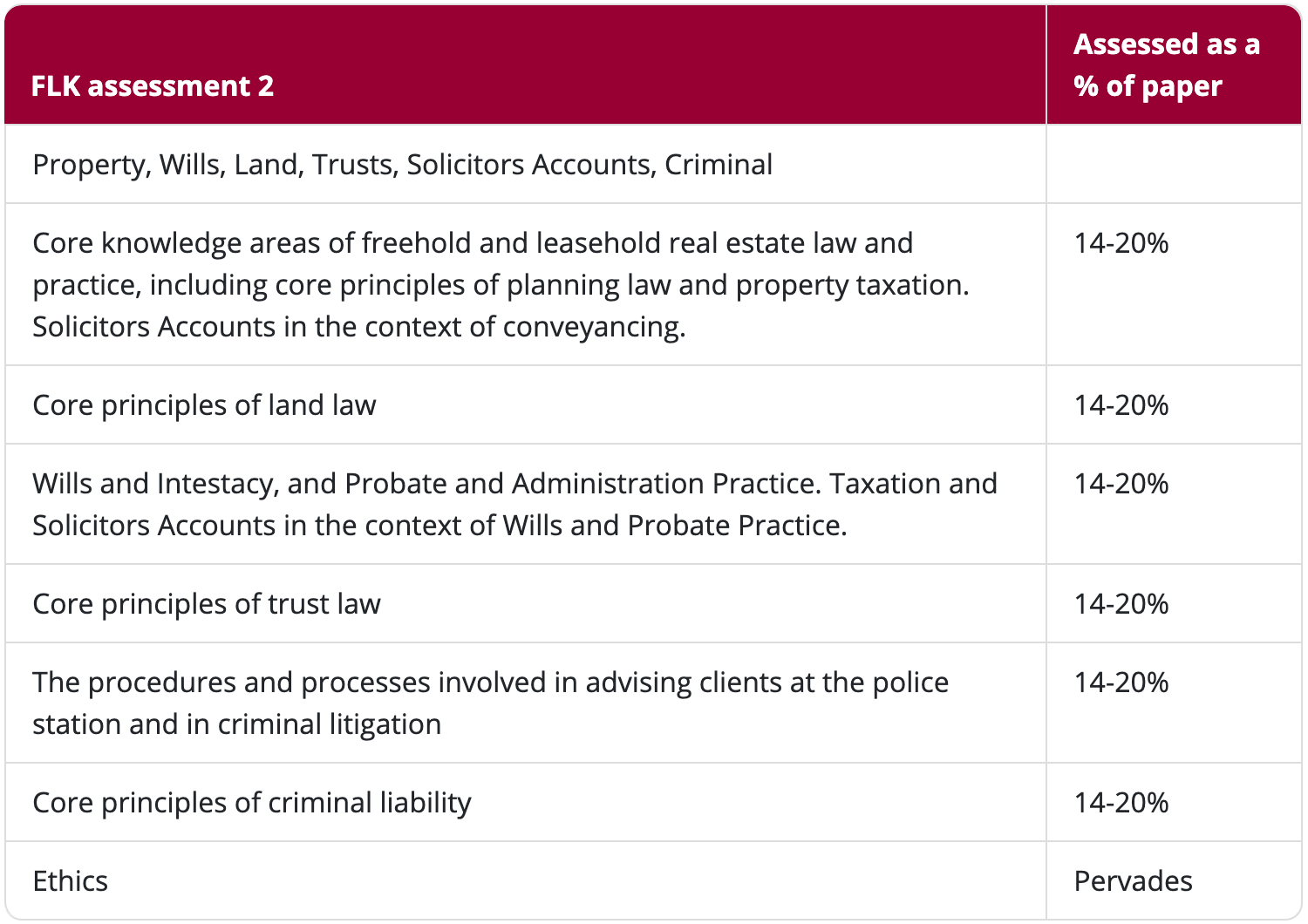

SQE1 assesses candidates' Functioning Legal Knowledge (FLK) across two comprehensive assessments. Each paper contains 180 single-best-answer questions administered over two days in a computer-based format. Candidates must pass both FLK1 and FLK2 to successfully complete SQE1; achieving the pass standard in only one assessment results in an overall fail.

- FLK1 encompasses: Business Law and Practice, Dispute Resolution, Contract Law, Tort Law, Legal System of England and Wales, Constitutional and Administrative Law (including retained EU law), and Legal Services. These areas primarily focus on commercial law and legal system knowledge.

- FLK2 encompasses: Property Practice and Land Law, Wills and Administration of Estates, Solicitors' Accounts, Criminal Law and Practice, and Trust Law. These subjects emphasise property, equity, and criminal law principles.

Professional Conduct permeates both assessments, appearing across all subject areas rather than as a standalone topic. Similarly, taxation principles are integrated into Business Law and Practice, Property Practice, and Wills and Administration rather than examined separately.

This framework requires candidates to demonstrate both breadth and depth of legal knowledge whilst applying principles to realistic scenarios representative of newly qualified solicitor practice.

Latest SRA Syllabus Updates: Key Points Analysis

Following the SRA's April 2025 annual syllabus review, no new subject areas have been introduced. The update focuses on clarification and guidance rather than substantive changes. The SRA has confirmed that subject weightings remain consistent: core FLK1 areas (Business Law, Civil Litigation, Contract, Tort, Constitutional/Administrative Law) each represent approximately 14-20% of the assessment, with Legal Services slightly lower at 12-16%.

Similarly, FLK2 maintains balanced coverage with Property Practice and Land Law, Wills and Administration, Trusts, and Criminal Law and Practice each comprising 14-20% of questions. This equilibrium means comprehensive preparation across all areas remains essential.

Important Update

The most significant clarification concerns Professional Conduct and Anti-Money Laundering provisions. The SRA has explicitly stated that these topics may constitute up to 20% of each SQE1 assessment (with AML questions limited to FLK1 only).

This update reflects heightened emphasis on professional ethics, practice standards, and financial crime prevention. Candidates should prepare for substantial ethics coverage, potentially reaching the 20% ceiling in upcoming examinations.

Additionally, the syllabus provides enhanced guidance on Professional Conduct scenarios, confirming that questions will be grounded in realistic client situations, including scenarios derived from SRA warning notices. Recent regulatory concerns such as Non-Disclosure Agreement misuse and Strategic Lawsuits Against Public Participation (SLAPP) may feature as question contexts, reflecting contemporary professional challenges.

CELE SQE Professional Advantage

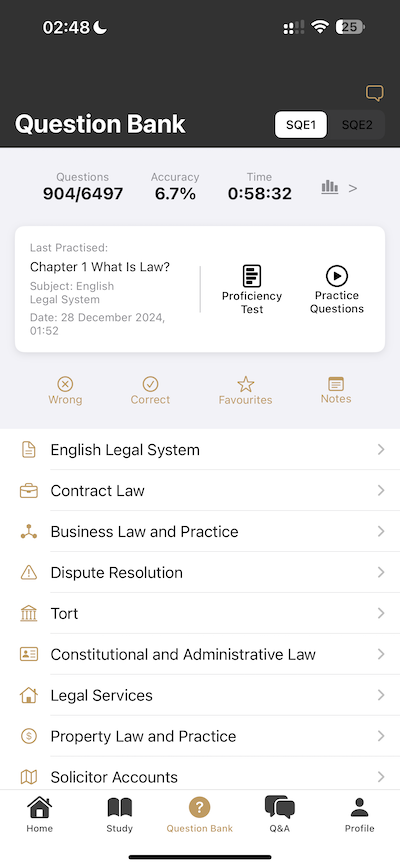

CELE updates approximately 150 questions monthly before each examination, providing precision-targeted predictions based on comprehensive syllabus analysis. Our expert team conducts detailed trend analysis to ensure maximum alignment between our question bank and actual examinations.

Recent Examination Trends and Pattern Analysis

Analysis of recent SQE1 sittings reveals several emerging patterns that inform our predictions for July 2025 and January 2026:

Increased Cross-Jurisdictional Integration

Contemporary SQE1 questions frequently integrate multiple subject areas within single scenarios. For instance, civil litigation questions may incorporate contractual or tortious elements, whilst property transactions might include taxation or accounts handling components. This integrated approach requires candidates to think holistically rather than compartmentalising legal knowledge.

Detail-Oriented Assessment Alongside Application

Despite SRA statements about avoiding excessive technical detail, recent examinations have included notably specific knowledge requirements. July 2024 candidates reported questions involving constitutional law minutiae, precise numerical requirements for company law procedures, and specific tax rates including Corporation Tax, Capital Gains Tax, and Stamp Duty Land Tax.

Reported examples include exact timeframes for litigation procedures, shareholding thresholds for company resolutions, and filing deadlines for corporate returns. These details caught many candidates unprepared, suggesting that memorisation of key figures and deadlines remains crucial.

CELE SQE Successful Predictions

Based on candidate feedback, CELE SQE successfully predicted numerous similar questions for recent examinations, achieving exceptionally high correlation rates. This trend reinforces the importance of mastering procedural details: limitation periods, appeal timeframes, document service requirements, and various percentage/numerical thresholds should be thoroughly memorised.

Enhanced Professional Conduct and Regulatory Focus

Professional Conduct questions have consistently represented a substantial portion of recent examinations, with trends suggesting increased emphasis. Beyond traditional SRA Code of Conduct provisions, Anti-Money Laundering compliance and client account regulations feature prominently, particularly in FLK1 business contexts.

Statistical analysis suggests Professional Conduct and AML questions approached 20% of recent papers, with the 2025 syllabus update now formally recognising this ceiling. Candidates must thoroughly understand SRA Codes of Conduct, the Money Laundering Regulations 2017 (as amended), and related guidance.

Examination Difficulty and Pass Rates

SQE1 pass rates since 2021 have fluctuated around 50%, indicating consistent challenging standards. July 2024 showed a 44% overall pass rate, whilst January 2025 improved to 56%, with first-time candidates achieving approximately 60% success. FLK2 consistently proves slightly more challenging, with January 2025 showing 61% pass rates compared to FLK1's 64%.

Candidate feedback suggests FLK2's property, trusts, and accounts questions present particular difficulties. Some candidates report discrepancies between practice question difficulty and actual examination complexity, emphasising the need for comprehensive, challenging preparation materials.

Candidate Background Considerations

SQE's international accessibility means diverse candidate backgrounds create varying strengths and weaknesses. Non-UK qualified lawyers often struggle with uniquely English constitutional and administrative law concepts, which can appear in seemingly peripheral questions but carry significant marking weight.

Legal system architecture, court hierarchies, and professional regulation topics require special attention for international candidates, whilst UK law graduates benefit from additional practice with application-based scenarios over theoretical knowledge.

July 2025 & January 2026 SQE1 Predictions

Based on syllabus developments and historical trends, we present detailed predictions for both examination periods across FLK1 and FLK2 components:

FLK1 Component: Priority Areas and Predictions

Professional Conduct and Compliance

July 2025 will likely maintain substantial Professional Conduct coverage integrated across business scenarios, particularly involving corporate transactions and client fund handling. By January 2026, following full syllabus implementation, expect Professional Conduct (including AML) questions to approach the 20% maximum threshold.

Particular attention should focus on SRA Code of Conduct provisions highlighted in recent warning notices, including confidentiality agreement misuse and SLAPP litigation concerns. Potential question scenarios include:

- Solicitors' use of NDAs to conceal client misconduct

- Compliance obligations when suspecting money laundering activity

- Professional conduct decisions regarding SLAPP litigation tactics

Professional Conduct questions often embed complex ethical dilemmas within seemingly straightforward scenarios, requiring careful analysis to identify the core professional obligations at stake.

Company Law and Business Practice

Business Law remains a substantial FLK1 component with consistently complex coverage. Future examinations will likely continue examining corporate governance specifics, particularly shareholder resolution requirements (ordinary versus special resolution thresholds) and director duties applications.

The Economic Crime and Corporate Transparency Act 2023 and related reforms may introduce novel elements if implementation occurs before examination dates. Enhanced company registration verification and increased penalty provisions could provide contemporary question contexts.

Taxation integration within business contexts is inevitable, requiring familiarity with Corporation Tax rates, VAT applications, and transactional stamp duties. January 2026 examinations, occurring near the financial year transition, may reflect any tax rate adjustments implemented during 2024/25.

Dispute Resolution (Civil Litigation Procedure)

Civil procedure remains consistently prominent, with limitation periods, court procedure timescales, and service requirements forming frequent question topics. Particular emphasis should be placed on limitation periods across different case types, court document filing and service deadlines, and multi-track versus fast-track procedure distinctions.

The Courts and Criminal Justice Act 2024 and related procedural reforms may influence question content, particularly regarding streamlined procedures and digital court processes. Pre-action protocols, Alternative Dispute Resolution requirements, and costs implications provide additional examination focal points.

Costs and funding arrangements, including Conditional Fee Arrangements and After the Event insurance, may feature more prominently as courts increasingly emphasise proportionality and ADR engagement.

Contract and Tort Law

As foundational private law subjects, contract and tort principles receive consistent examination coverage. Contract law questions will likely focus on formation requirements, breach remedies (damages types, equitable relief), and contemporary commercial contexts.

Recent consumer protection developments and digital services legislation may provide novel question scenarios, whilst maintaining focus on established principles. The Consumer Rights Act 2015 and emerging digital content contract rules could feature if within syllabus scope.

Tort law emphasis continues on negligence fundamentals (duty, breach, causation, damage), employer liability, occupier liability, and product liability. Technology-related scenarios (data breaches, autonomous vehicle incidents) may appear whilst applying traditional doctrinal frameworks.

Legal System and Public Law

Constitutional and administrative law, plus legal system architecture, whilst representing smaller question volumes, can significantly impact overall performance. Parliamentary sovereignty, judicial independence, and judicial review principles remain core examination areas.

Recent constitutional developments (Supreme Court decisions on devolution powers, Brexit-related constitutional adjustments) may generate questions if occurring within syllabus timeframes. January 2026 may incorporate 2024-25 constitutional developments, particularly regarding retained EU law implementation under the Retained EU Law (Revocation and Reform) Act 2023.

Legal Services provisions cover regulatory frameworks, client complaint mechanisms, and professional structure. Updated SRA regulations regarding solicitor firm management and fee transparency requirements may feature in examination scenarios.

CELE SQE Question Bank Advantage

CELE SQE has historically provided extensive coverage of these subject areas, with continuous pre-examination updates ensuring comprehensive preparation for all identified priority topics.

FLK2 Component: Priority Areas and Predictions

Property Practice and Land Law

Property and land law consistently represent FLK2's largest components, requiring detailed procedural and substantive knowledge. Both July 2025 and January 2026 examinations will likely emphasise conveyancing processes, including contract exchange, completion procedures, and registration requirements, alongside fundamental land law principles.

Essential topics include freehold/leasehold distinctions, registered land priority rules, third-party interests (easements, covenants, adverse possession), and conveyancing solicitor responsibilities. Recent or pending leasehold reform proposals may influence examination content, particularly commonhold conversion and ground rent restrictions.

Planning and environmental law receive limited coverage but may appear contextually. Stamp Duty Land Tax calculations and applications provide additional examination opportunities, particularly in transaction-based scenarios requiring next-step identification or legal consequence analysis.

Wills, Succession and Estate Administration

This component examines personal wealth transmission legal frameworks. Valid will requirements (execution formalities, testamentary capacity), intestacy rules, and probate/administration procedures remain central examination topics.

Questions may require analysis of will clause validity, intestacy distribution calculations, or executor/administrator duty applications. Estate administration procedure modernisation (digital probate applications, streamlined inheritance tax reporting) reflects contemporary practice whilst maintaining traditional legal principles.

Inheritance Tax and gift tax principles require basic understanding, though detailed calculations remain beyond scope. Any 2025 changes to spousal provision levels or inheritance tax thresholds could feature in January 2026 questions involving numerical calculations or threshold applications.

Family relationship complexity (remarriage, stepchildren, cohabitation) commonly provides question scenarios requiring careful application of succession rules and testamentary interpretation principles.

Trust Law

Trust law's conceptual complexity makes it consistently challenging for candidates. Fundamental principles including trust creation requirements (three certainties), trustee duties and beneficiary rights, and charitable/resulting trust distinctions remain core examination areas.

Question scenarios typically present trust arrangements requiring validity assessment or trustee conduct evaluation. Will trusts versus inter vivos trusts, constructive trusts, and resulting trusts applications provide frequent examination contexts.

Whilst abstract, trust law questions require practical application skills. Historical case law principles (cases specified in syllabus appendices) should be thoroughly understood, as examination questions often test rule application rather than case name memorisation.

Predicted examination areas include secret trust requirements, trustee self-dealing prohibitions, and mixed fund tracing remedies. Understanding logical frameworks rather than rote memorisation proves most effective for trust law preparation.

Solicitors' Accounts and Financial Regulation

Despite representing fewer questions, accounts provisions frequently challenge candidates and significantly impact pass rates. Both examinations will likely include 5-6 questions focusing on client account rules practical application.

Key areas include client money identification and protection requirements, account transfer procedures, and overdraft/surplus handling protocols. SRA Accounts Rules provisions require precise understanding and careful application to scenario-based questions.

Basic bookkeeping principles and double-entry accounting concepts may feature, alongside specific calculations involving client money movements. International candidates particularly benefit from dedicated preparation for UK-specific financial terminology and regulatory requirements.

Anti-money laundering integration within accounts scenarios may increase, reflecting regulatory emphasis on financial crime prevention and client due diligence requirements.

Criminal Law and Criminal Practice

Criminal law and procedure maintain significant FLK2 representation, with contemporary legal developments potentially influencing question content. Core offences (homicide categories, assault classifications, theft, fraud) and defence applications (self-defence, insanity) remain fundamental examination topics.

Criminal procedure emphasis includes police detention and bail limitations, sentencing guidelines, and jury trial requirements. The Sentencing Act 2024 provisions regarding early release modifications (standard sentence release changing from 50% to 40% custody time) may feature in January 2026 examinations.

Public order legislation updates and protest-related criminal law changes may provide contemporary question contexts, whilst maintaining focus on established procedural and substantive principles.

Police interview procedures (caution rights, legal representation), evidence admissibility, and appeals processes provide additional examination topics. July 2025 may emphasise traditional applications, whilst January 2026 could incorporate 2024-25 legislative or guideline changes.

Comprehensive Question Bank Support

CELE SQE maintains extensive question coverage across all FLK2 components, with regular pre-examination updates ensuring thorough preparation for predicted priority areas and emerging topics.

Overall, FLK2 examinations will continue emphasising broad subject coverage with detailed application requirements. Property and criminal law represent substantial marking opportunities requiring confident knowledge application, whilst trusts and accounts demand precision despite lower question volumes. Contemporary legal developments provide fresh question contexts whilst maintaining focus on fundamental principles essential for newly qualified solicitor practice.

Conclusion and Preparation Recommendations

The forthcoming July 2025 and January 2026 SQE1 examinations require strategic preparation combining comprehensive subject coverage with targeted emphasis on identified priority areas. Our analysis demonstrates that while SQE1 maintains broad coverage across all syllabus components, certain trends indicate heightened focus on professional conduct, procedural details, and integrated scenario-based applications.

To maximise preparation effectiveness, candidates should adopt the following strategic approach:

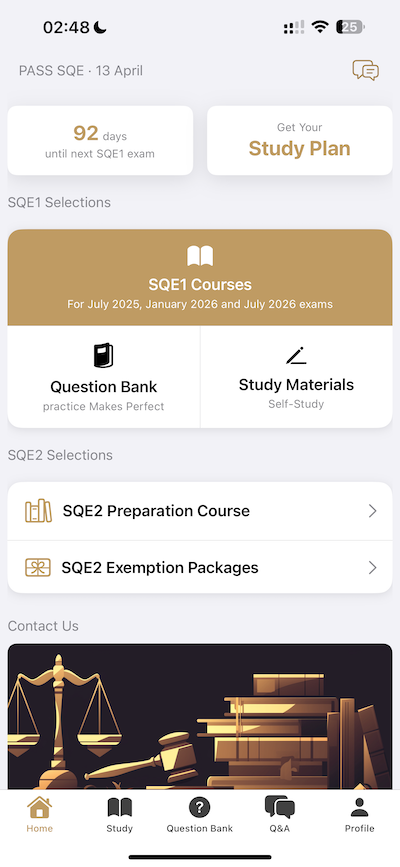

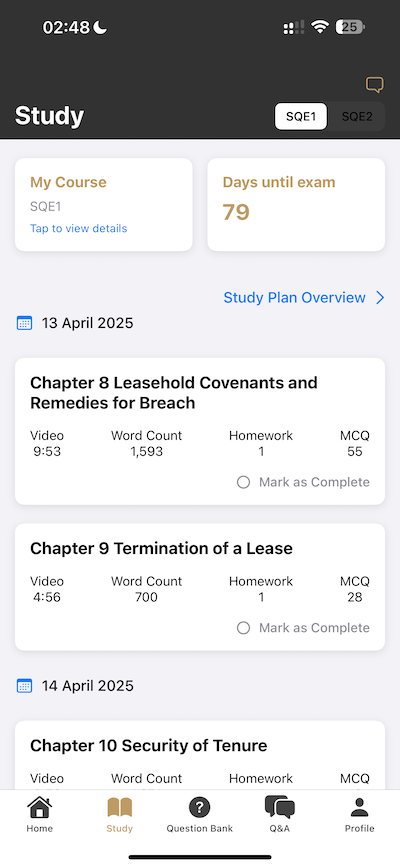

- Master Official Resources: Thoroughly engage with SRA syllabus specifications and specimen questions. The official syllabus provides definitive preparation scope, whilst specimen questions demonstrate examination style and approach. The SRA's November 2024 specimen question expansion to 170 questions (covering FLK1 and FLK2) offers invaluable insight into contemporary question formats and should be systematically analysed. Additionally, review incorrect answers in your PASS SQE APP error log and mark frequently missed topics in study materials for comprehensive knowledge gap identification and targeted improvement.

- Develop Comprehensive Knowledge Lists with Detail Focus: Create systematic knowledge inventories for each subject area, ensuring complete syllabus coverage. Pay particular attention to numerical details (timeframes, percentages, monetary thresholds) requiring precise memorisation. Civil litigation deadlines, company law shareholding requirements, criminal procedure time limits, and succession law entitlements should be thoroughly committed to memory. Consider using flashcards or systematic review schedules for these detail-intensive components.

- Intensive Scenario-Based Practice: SQE1's distinguishing feature involves complex scenario analysis requiring sophisticated legal application skills. Extensive practice with multiple-choice questions across varying difficulty levels and styles proves essential. Historical candidates emphasise that question practice develops pattern recognition and application techniques extending beyond basic rule memorisation. Utilise PASS SQE question bank functionality including targeted practice sessions and timed mock examinations to build both knowledge application confidence and examination technique proficiency.

- Monitor Legal Developments: Stay current with 2024-2025 legal changes potentially affecting examination content. Criminal law sentencing modifications, corporate transparency requirements, and anti-money laundering updates may feature if implemented within examination timeframes. Subscribe to SRA updates and reputable legal news sources to identify potentially relevant developments. For significant changes, practice creating sample questions to test understanding depth.

- Strategic Time Management: Plan preparation schedules aligned with examination dates. July 2025 candidates (registration closed 22 May) should focus on intensive consolidation and practice phases, allocating weekly time blocks across all subjects whilst maintaining regular knowledge review. January 2026 candidates benefit from longer preparation periods, allowing systematic foundation building followed by intensive application practice, reserving final month for comprehensive mock examination and weak area remediation.

- Utilise Diverse Preparation Resources: Combine multiple learning approaches including textbooks, online courses, practice questions, and peer discussion. CELE SQE courses and materials provide structured foundation building, whilst the mobile app enables flexible practice and mock examination familiarisation. Maintain balanced mental health and study routines, avoiding excessive pre-examination stress that may impair memory retention and performance.

Final Reminders

SQE1 examinations present substantial challenges but remain systematically approachable through methodical preparation. Official syllabi provide clear preparation frameworks, whilst historical examination patterns reveal consistent priority areas and emerging trends. Through this comprehensive analysis, we hope candidates gain enhanced understanding of July 2025 and January 2026 examination priorities. During final preparation phases, maintain comprehensive foundation knowledge whilst targeting identified priority areas strategically. Success requires balancing breadth with depth, ensuring no subject area receives inadequate attention whilst developing particular strength in high-frequency topics.

Best wishes for successful preparation and examination performance!