As the UK legal market enters 2025-2026, a blend of established and emerging trends presents both opportunities and challenges for aspiring solicitors pursuing the SQE qualification. This comprehensive analysis examines the overall trajectory of the English legal profession from 2025 to 2026, forecasts the legal talent market for 2026, and explores policy directions from the UK Government and the Solicitors Regulation Authority (SRA). Whether you're a candidate from mainland China, Hong Kong, Macau, Taiwan, an overseas student, a UK-based professional from the Chinese community, or considering a career change, this article provides authoritative yet accessible insights to help you understand the 2026 legal employment landscape and confidently embark on your journey to becoming an English solicitor.

I. Overall Trends in the UK Legal Sector 2025-2026

Steady Market Growth with Expanding Employment Opportunities

The UK legal services market has maintained robust growth momentum in recent years. Authoritative reports indicate that the UK legal services market reached £51.9 billion in 2024, representing a 10.1% increase from 2023, with further growth of 8.1% projected for 2025. This expansion reflects rising demand for legal services and translates to increased employment opportunities across the sector.

Notably, whilst market expansion has occurred alongside structural changes in the industry - over the past five years, the number of law firms has decreased by approximately 1,100 (primarily due to smaller firm consolidations), the number of practising certificate holders has increased by 14% (approximately 21,000 additional practising solicitors). This indicates a trend towards concentration of legal talent in larger firms or in-house legal departments, accelerating industry consolidation whilst maintaining steady growth in the overall number of legal practitioners.

Figure: The UK has established itself as a global LawTech innovation hub, hosting over 350 legal technology companies. Through technological advancement, law firms are continuously improving service efficiency and developing new business models to meet client demands for efficient, transparent legal services.

Corporate Legal Services Leading Growth, Emerging Sectors Gaining Momentum

Within practice areas, commercial and corporate law continues to dominate the market, accounting for 51% of total legal services value. Mergers and acquisitions, finance, and compliance sectors show particularly strong growth. Technology, finance, and compliance-related legal services are experiencing rapid expansion - client legal spending on regulatory compliance has increased by 31%, whilst banking and finance legal expenditure is projected to grow by 12%.

High-Growth Practice Areas

Technology Law: Data privacy, AI regulation, digital finance compliance

ESG Legal: Environmental law, sustainability, carbon neutrality compliance

Immigration Law: Family visas, corporate immigration, policy advisory

FinTech: Cryptocurrency, digital payments, regulatory technology

These figures reflect how technology innovation, digital finance, and new regulatory requirements are driving technology law, financial law, and compliance/regulatory law to emerge as industry highlights. Simultaneously, developments in renewable energy and environmental sectors are elevating ESG legal work: surveys show nearly 60% of UK law firms expect client demand for environmental, social, and governance (ESG) legal advisory services to continue rising over the next three years.

Many firms have begun strengthening their ESG specialist teams to meet increasingly complex corporate compliance requirements around carbon neutrality and sustainable development. Additionally, geopolitical and policy changes are driving demand in immigration law - UK net migration has reached record highs in recent years, generating substantial demand for family and corporate visa advisory services and immigration compliance consulting, creating greater opportunities for solicitors versed in immigration policy.

Looking ahead to 2026, emerging legal fields such as technology and data privacy, FinTech compliance, environmental law, and immigration policy consulting are expected to maintain strong growth potential, generating numerous specialist positions.

Recruitment Trends and Law Firm Internationalisation

The flourishing legal market is reflected in recruitment activity. The 2025 legal employment market shows steady upward momentum, with recruitment opportunities significantly increasing compared to the previous year. According to recruitment agency statistics, corporate legal positions across the UK increased by nearly 20% year-on-year in Q1 2025, spanning roles from legal assistants to general counsel.

Several previously subdued sectors (such as technology and fast-moving consumer goods) began recovering in the second half of 2024, driving increased demand for legal talent, whilst sectors like energy and real estate maintained high demand for solicitors through early 2025. Among major law firms, as business recovers and expands, many firms have reactivated large-scale recruitment programmes, including graduate recruitment and expanded training contract allocations.

Concurrently, internationalisation trends are increasingly evident: London's position as a global legal centre has been further consolidated, with all of the world's top 50 law firms maintaining offices in London, and over 200 foreign law firms from approximately 40 jurisdictions operating in the UK. US firms have particularly accelerated their expansion into the London market, with nearly 90 top-tier American firms now operating London offices, competing with UK domestic firms for clients and top legal talent.

International Opportunities

Currently, over 7,000 foreign-qualified lawyers practise in England and Wales, whilst approximately 6,500 England and Wales qualified solicitors work abroad serving global clients. This presents excellent development opportunities for lawyers familiar with multiple legal systems and possessing language and cross-cultural capabilities.

Litigation Practice Divergence and Flexible Service Models

Notably, different practice areas are experiencing divergent development trends. Against a backdrop of economic uncertainty, corporates tend to control legal costs, leading to sluggish growth or even slight decline in routine commercial litigation and insurance claims. Conversely, specific dispute resolution areas such as international arbitration and collective litigation remain active in London, particularly with substantial growth in new collective litigation cases involving consumer rights, competition law, environmental claims, and data breaches.

Responding to changing client demands, law firms are exploring new service and billing models to enhance competitiveness. For instance, increasing numbers of clients favour fixed fees or value-based pricing over traditional hourly billing, compelling firms to improve efficiency and adopt legal technology to reduce costs.

Technology innovation in legal services is becoming increasingly prevalent: the UK hosts approximately 44% of Europe's LawTech startups, with over 350 LawTech companies based in the UK, attracting over £5.5 billion in investment in 2023.

Figure: The UK has become a global LawTech innovation centre, home to over 350 legal technology companies. Through technological advancement, law firms are continuously improving service efficiency and developing new business models to meet client demands for efficient, transparent legal services.

Looking ahead, legal technology's role in enhancing industry efficiency and creating new business models will become increasingly prominent. Projections suggest that by 2026, the UK LawTech sector could employ 15,000 people with annual output exceeding £1.5 billion. The digital transformation of legal services is expected to deepen further in 2025-2026, from online legal consultation platforms to contract automation and AI legal research - all innovations will become the new normal for the solicitors' profession.

II. Analysis and Forecast of the UK Legal Talent Market for 2026

Changes in Talent Demand Among Law Firms and Employers

Looking towards 2026, the UK legal talent market will present a diversified landscape. Major commercial law firms are expected to continue expanding key practice teams, particularly in mergers and acquisitions, private equity, and financial regulation, to meet legal demand arising from market recovery. Some firms began strengthening capabilities in 2025 through lateral partner hires, with frequent senior-level partner moves in London in 2024 (with firms like Weil and Paul Weiss recruiting heavyweight partners in London) - this trend may continue through 2025-2026.

Meanwhile, small and medium-sized firms and regional practices are actively seeking specialisation opportunities. According to a Law Society survey, nearly half of firms (49.3%) believe they can expand market share by providing expertise in specific practice areas or industry sectors. Therefore, in 2026 we may see more mid-tier firms focusing recruitment on niche markets (such as sports law or fashion industry law) to build differentiated competitive advantages.

In corporate legal departments, recruitment demand remains strong. Whilst some large corporate legal positions slowed recruitment in 2024 due to economic uncertainty, there was a clear rebound from early 2025. As commercial activity recovers, corporates place greater emphasis on internal legal compliance and risk management, with reports showing in-house legal positions increasing by approximately 20% year-on-year in 2025.

In-House Legal Demand Hotspots

From tech startups to multinational corporations, all require more commercially-minded lawyers to join internal teams, particularly providing support in data compliance, intellectual property, employment law, and ESG reporting.

Similarly, government and public sector demand for legal talent cannot be overlooked. The Government Legal Department (GLD) has seen increased workload in recent years, involving post-Brexit regulatory development, international treaty negotiations, and domestic legislative reform. Reports indicate that government legal services departments will increase establishment and recruit more solicitors in 2025-2026 to handle extensive responsibilities (such as addressing immigration law reform and public inquiries). Therefore, legal professionals aspiring to public sector careers will have certain opportunities.

Competitiveness and Trends of SQE Talent

As the SQE system matures, newly qualified solicitors holding SQE qualifications are progressively entering the talent market, complementing those from traditional routes. Since the SQE's introduction in 2021, thousands have become English solicitors through this new pathway. Data shows that by early 2024, approximately 2,750 candidates had successfully obtained practising qualifications by passing SQE1 and SQE2 and completing qualifying work experience requirements.

Particularly in the past year, SQE application numbers have surged significantly: the January 2024 SQE1 examination alone attracted nearly 6,500 participants. Looking ahead to 2025-2026, more SQE candidates will continuously enter the solicitors' profession.

For employers, SQE-trained talent offers more flexible and diverse backgrounds, precisely matching the industry's diversification needs. On one hand, major law firms have fully embraced SQE-route newly qualified solicitors - many top-tier firms (such as White & Case) switched to the SQE system for training their trainee solicitors from 2024. Many firms also provide SQE examination fee support and training courses, demonstrating support and recognition for SQE new talent.

On the other hand, some SQE newly qualified solicitors without traditional training contracts obtained qualifications by accumulating qualifying work experience (QWE) at different institutions, often possessing rich grassroots practical experience (such as years as litigation assistants or legal advisors), demonstrating strong practical skills and high professional motivation. These SQE newly qualified solicitors show impressive competitiveness in the employment market, particularly popular for junior solicitor positions in law firms and entry-level corporate legal roles.

The SQE unified examination provides objective standards - regardless of background, anyone able to pass SQE examinations and complete two years of qualifying work experience demonstrates capability, representing a valuable qualification in itself.

Opportunities and Challenges for International and Non-Traditional Background Candidates

Notably, the SQE has significantly broadened access to the solicitors' profession, attracting numerous overseas law graduates and other non-traditional background professionals. SRA statistics show that in the January 2024 SQE1 examination, nearly one-third of candidates completed secondary education outside the UK - indicating a substantial proportion from overseas students or immigrant communities.

Moreover, SQE candidates demonstrate greater age and experience diversity: many professionals (such as former corporate managers, contract managers) choose to transition to becoming solicitors through SQE examinations after several years of work. For these international or career-change candidates, the UK solicitors' market presents both abundant opportunities and practical challenges.

International Candidate Opportunities

Language advantages: Growing demand for multilingual lawyers familiar with different legal cultures

International business: Firms with Asian operations welcome Mandarin-speaking Chinese lawyers

Dual opportunities: Choice between UK practice or returning home for cross-border legal work

Global recognition: English law's status as preferred law for international commercial contracts

Challenges Faced

Examination difficulty: SQE1 overall pass rates fluctuate around 50-60%

Local experience: Employers prefer candidates with UK internship or work experience

Visa requirements: Need advance planning for work visa routes

Cultural adaptation: Need to adapt to UK legal culture and practice environment

Whilst these challenges exist, they are not insurmountable. Overall, as the UK solicitors' profession becomes increasingly open and inclusive, SQE holders from diverse backgrounds can certainly secure positions in the 2026 UK legal marketplace through dedication and policy support.

Salary and Career Return Trends

Alongside positive employment trends, we must consider salary trends in the UK solicitors' profession. Generally, solicitor remuneration has risen steadily since 2025. Surveys show the industry-wide average annual salary for legal professionals increased to approximately £67,200 in 2025, with over 60% of legal professionals receiving pay rises in the past year.

This reflects both the legal services market's prosperity enabling firms and companies to increase compensation, and intense talent competition compelling employers to offer more attractive salaries and benefits.

Geographically, London solicitor salaries remain significantly ahead of other regions, with newly qualified (NQ) starting salaries averaging £65,000-£85,000 annually in London. Top commercial firms offer even higher six-figure starting salaries: according to industry reports, Magic Circle firm NQ starting salaries have risen to approximately £110k-£125k in recent years, with total packages including bonuses reaching around £150k; US firm London NQ salaries are even higher, reaching the remarkable level of £160k-£180k.

This "salary arms race" undoubtedly makes the UK one of the world's highest-paying legal markets. For newly qualified solicitors entering through the SQE route, provided they demonstrate outstanding capability, they can share in these benefits - many medium and large firms offer SQE newly qualified solicitors starting salaries comparable to traditional route counterparts, with some particularly exceptional SQE newly qualified solicitors achieving substantial salary increases when changing firms.

UK Solicitor Salary Reality Check

Hear from practising solicitors about real salary levels and cost of living analysis in England

🎬 Video Content Overview:

- UK solicitor income and career progression opportunities 💰

- Salary composition and deductions 📝

- Effective income management and savings strategies 💸

- Cost of living analysis: rent 🏠, transport 🚆, leisure 🍽️ expenses

- Why financial transparency matters for personal and professional development 🌟

💡 Through this video, you'll gain the most authentic and intuitive insights into UK solicitor compensation, helping you better plan your legal career development path.

III. UK Government and SRA Policy Direction Outlook

The UK Government and legal regulatory bodies have introduced a series of initiatives in recent years aimed at supporting diversification and internationalisation in the legal services sector, injecting positive momentum into the industry ecosystem around 2026.

Encouraging Diverse Backgrounds, Enhancing Industry Inclusivity

The judiciary and SRA place high importance on diversification of the legal profession. The SRA explicitly listed equality, diversity, and inclusion (EDI) as one of its key work directions in its 2024/25 business plan. The Law Society has welcomed this, emphasising the need to address gaps in professional examinations.

Indeed, since the SQE's introduction, the SRA has consistently sought to create a level playing field for candidates from different backgrounds. Despite current SQE examination results still showing pass rate differences between ethnic groups (with White candidates achieving higher pass rates than ethnic minority candidates), the SRA is improving examination design and providing enhanced preparation support to narrow this gap.

Simultaneously, the SRA continues improving diversity data collection, requiring all law firms to regularly report employee diversity information to develop targeted improvement measures. At the government level, support is provided through scholarships and internship programmes encouraging entry to the legal profession from low-income families and ethnic minority groups.

Supporting Legal Services Internationalisation, Consolidating Global Centre Status

The UK Government explicitly positions legal services as one of the nation's key economic pillars. The Ministry of Justice launched the "Legal Services are GREAT" global promotion campaign in 2017, continuously promoting UK legal services advantages overseas. In 2023, the UK legal services trade surplus reached £7.6 billion, highlighting legal exports' economic contribution.

To maintain this leading position, government and industry organisations are active on multiple levels: promoting English law as governing law for international transactions, leveraging the excellent reputation of UK courts and London arbitration to attract international disputes to the UK for resolution. Events such as the annual London International Disputes Week (LIDW) feature government officials promoting the UK's world-class legal expertise and innovation.

International Cooperation Initiatives

The UK actively uses diplomatic channels to reduce international lawyer practice barriers, such as signing legal cooperation memoranda with Singapore, exploring bilateral lawyer cross-border practice mechanisms, and including legal services liberalisation clauses in free trade agreements.

Regulatory Innovation and Small Firm Support

The SRA is actively promoting regulatory innovation to help the industry better adapt to new era requirements. A highlight is tolerance for new business models: since the Legal Services Act 2007, England and Wales has permitted non-lawyer investment and management of legal businesses, with approximately 12% of law firms currently adopting Alternative Business Structures (ABS).

This opens doors for legal services integration with other industries, such as accounting firms establishing legal departments and LawTech companies providing regulated legal services. The SRA indicates it will continue refining ABS regulation, encouraging more innovation to enter the market.

Regarding technology adoption, regulators maintain a cautiously supportive stance. The SRA collaborates with law firms to develop guidance, helping small and medium firms adopt appropriate technology to improve efficiency. Additionally, in lawyer training, regulatory bodies increasingly favour providing guidance rather than mandatory rules, allowing markets to explore best practices.

Overall, UK Government and SRA policy direction can be summarised as: diverse, international, and innovative. For aspiring 2026 solicitors, this means a more open, inclusive, and dynamic practice environment.

IV. Conclusion: Embracing Opportunities, Embarking on the English Solicitor Journey

Looking towards 2026, the UK solicitors' profession is in an upward cycle: growing market demand, emerging new fields, increasing internationalisation, and welcoming diverse talent. This is undoubtedly encouraging news for all aspiring solicitors. Whether you're a fresh law school graduate or a professional considering career change, whether based domestically or overseas, provided you maintain clear goals and adequate preparation, the path to becoming an English solicitor lies open before you.

Certainly, the path ahead presents challenges - intense examination competition, balancing demanding study and work, adapting to new cultural and practice environments. However, as our data analysis demonstrates, persevering through SQE examinations represents a worthwhile investment. The SQE provides a fair starting line for people from different backgrounds, enabling dedicated individuals to demonstrate their capabilities and join the ranks of the world's most distinguished legal practitioners.

As industry recognition and acceptance of new practitioners increases, SQE solicitors can compete alongside traditional route solicitors in the employment market, even distinguishing themselves through unique advantages.

Action Recommendations

Start immediately: Begin preparing for SQE examinations and develop study plans

Gain experience: Seek relevant internships and work opportunities

Stay informed: Continue monitoring latest industry trends and policies

Plan careers: Thoroughly research your solicitor career path

The curtain has risen on 2026, with new chapters for legal professionals awaiting. If you harbour dreams of becoming an English solicitor, now is the optimal time for action. Begin preparing for SQE examinations, accumulate relevant internship experience, monitor latest industry developments and policy support, and thoroughly research your career planning. We believe that in the near future, you too can stand in London courtrooms or at international transaction negotiating tables as a proud practising solicitor.

Opportunity favours the prepared mind. Let us write our solicitor careers with dedication as our pen. The journey to join the English solicitors' profession has begun - we look forward to the near future when more like-minded Chinese candidates and legal professionals will shine together on the legal stage across the Atlantic!

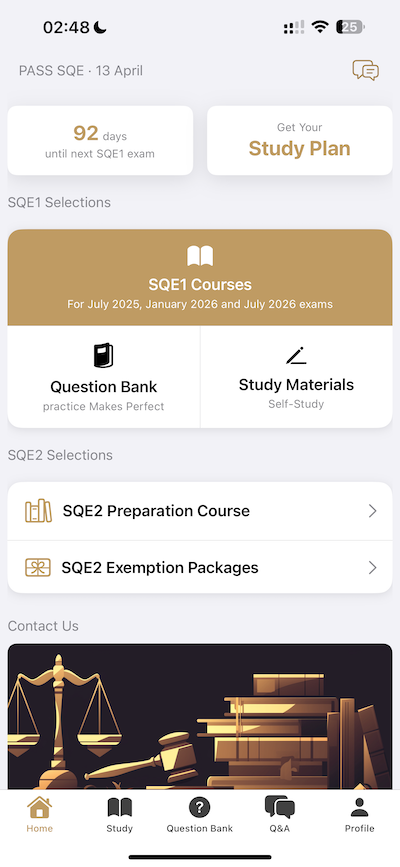

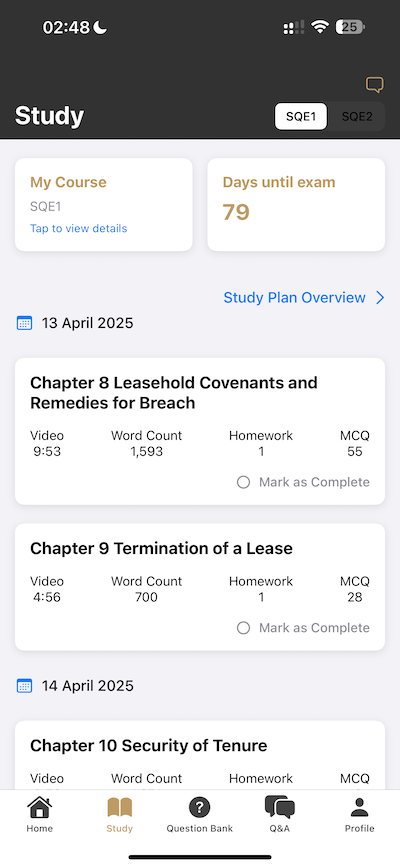

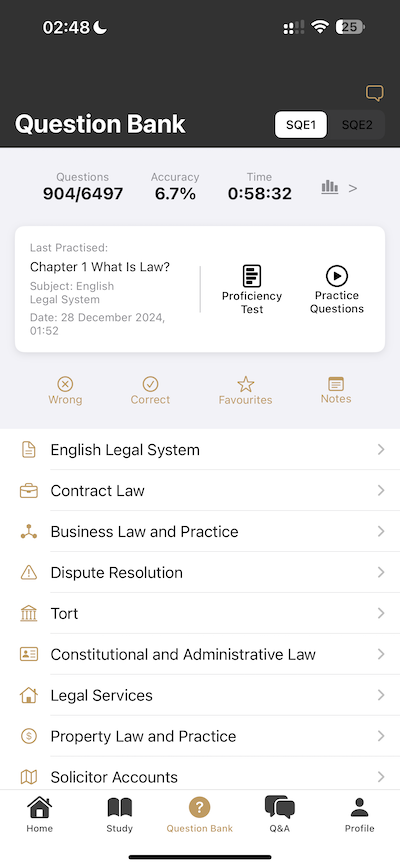

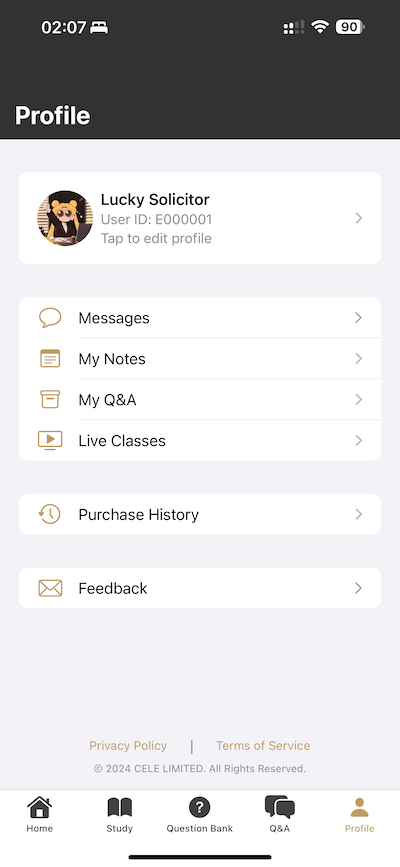

Begin Your SQE Journey

Click to download the PASS SQE App and start your English solicitor journey today!